Priced in

April 7, 2025 at 8:15 AM by Dr. Drang

One economic constant you can hang onto in volatile times is that experts will appear on your TV and computer screens to tell you that The Market has already priced in whatever big change we’re going through. This is because the Masters of the Universe have such finely tuned senses that they can predict with great accuracy what the rest of us haven’t the slightest notion of.

It doesn’t matter how demonstrably false this is; they will say it anyway, as if there’s some trigger in their heads that makes this come out of their mouths and keyboards whenever they’re asked to explain the goings-on of Wall Street. This even happened on Thursday evening, after stocks had fallen off a cliff. “Oh no,” I heard several say, “The Market had already mostly accounted for Trump’s tariffs. It just needed to adjust to their size.”

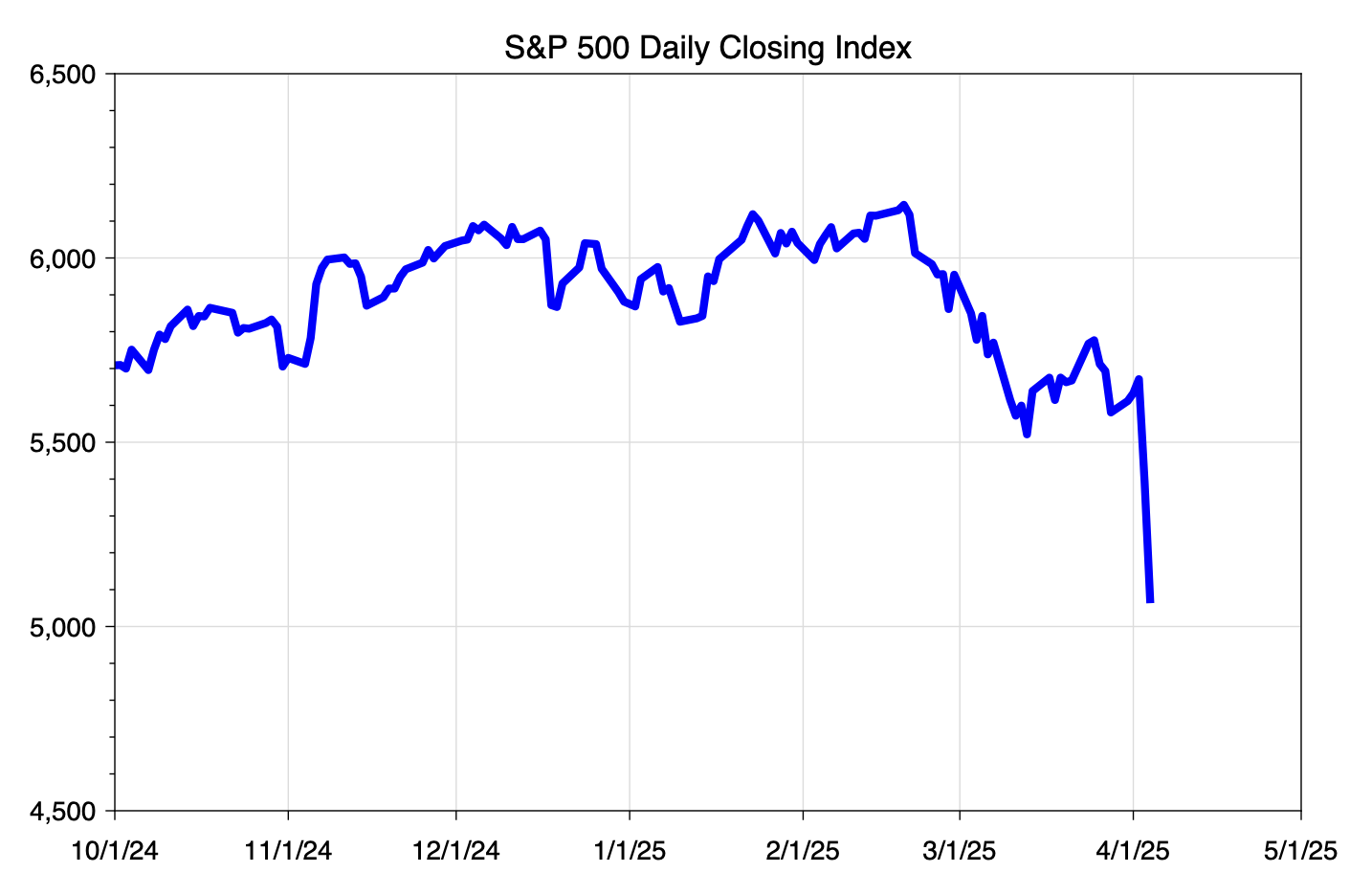

Here are the closing values of the S&P 500 index from the beginning of October through last Friday:

What do you think? Trump ran on a policy of raising tariffs. It was one of the few things he was consistent on. And it was well known that he wasn’t going to bring any traditional Republicans into his administration who might slow-walk his proposals. So did The Market lose value in anticipation of the Trump tariffs back in October, when it looked like he had a good chance of winning? What about after the November election? After his inauguration?

There was definitely a drop for about three weeks in late February and early March. This was three weeks after he announced the tariffs on Canada, China, and Mexico—does that count as a prediction? The drop did start about a week before the end of the 30-day pause on those tariffs, so maybe that’s considered a prediction on Wall Street. But some of that drop was erased by a rise over the next couple of weeks. What signs of optimism were there during that period?

The S&P 500 even went up last Wednesday, when it was known that he was going to make an announcement after trading closed. By that time everyone knew he was going to say something bad—that’s the reason he waited until after closing. But still there was no anticipatory drop.

I confess I didn’t read/watch/listen to any analysts on Friday night. Maybe they all said they’d been wrong about The Market and would never make that mistake again. And maybe my 401k went up.